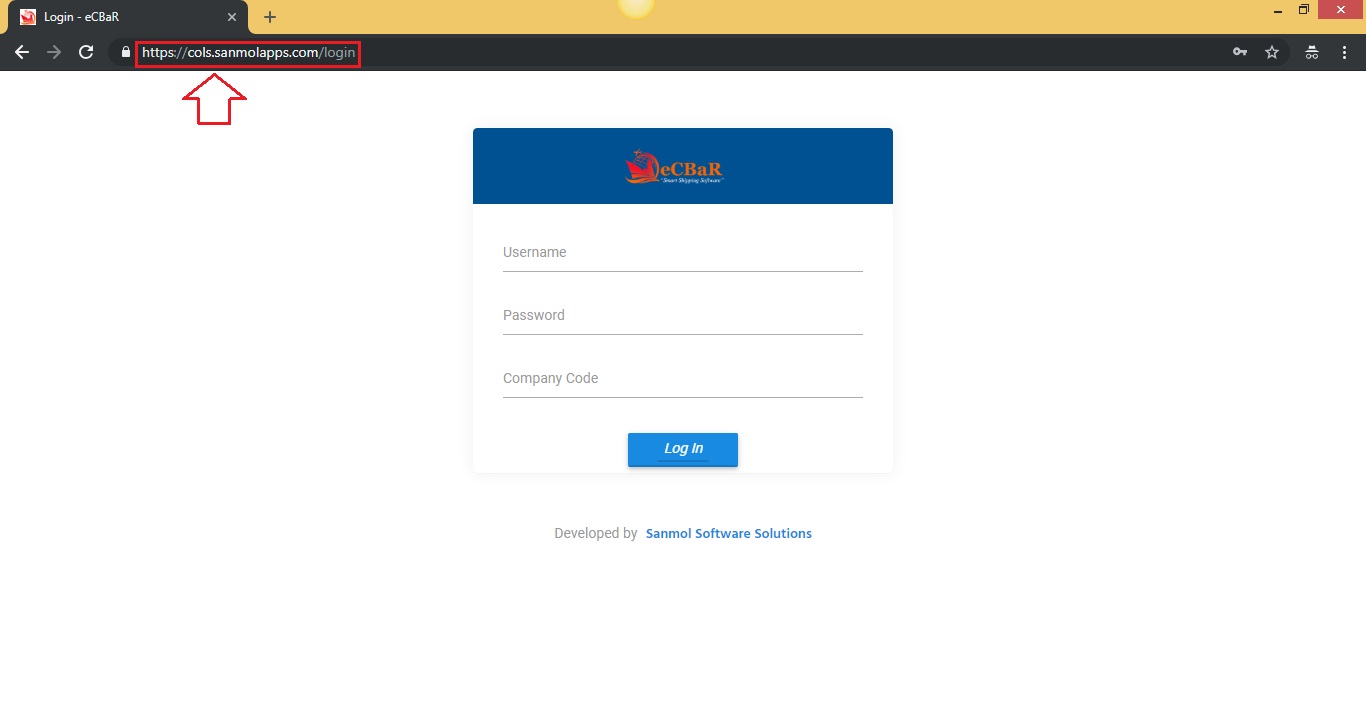

1. eCOLS URL

Please enter URL of the eCOLS application as per shown in the screen.

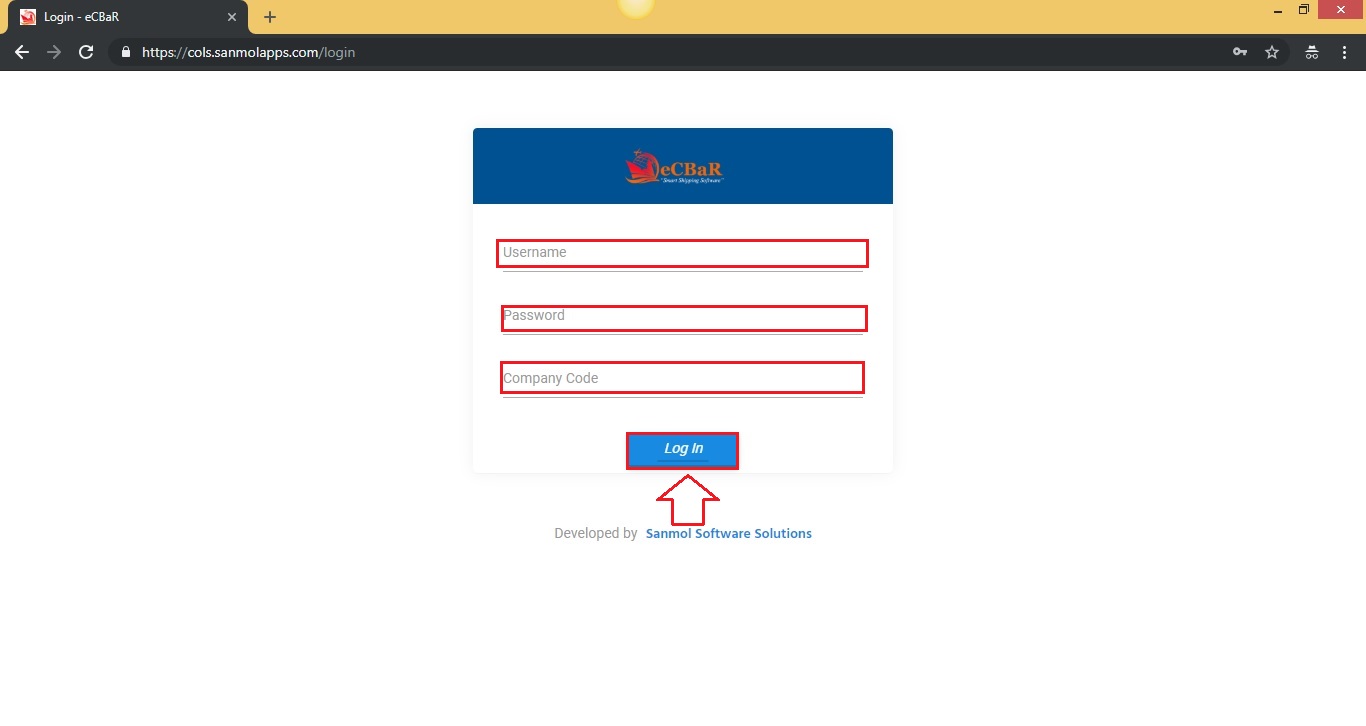

2. Login Page

Please enter your username, password and company id which is provided by Sanmol Software.

3. Dashboard

After successful login you will redirect to the dashboard.

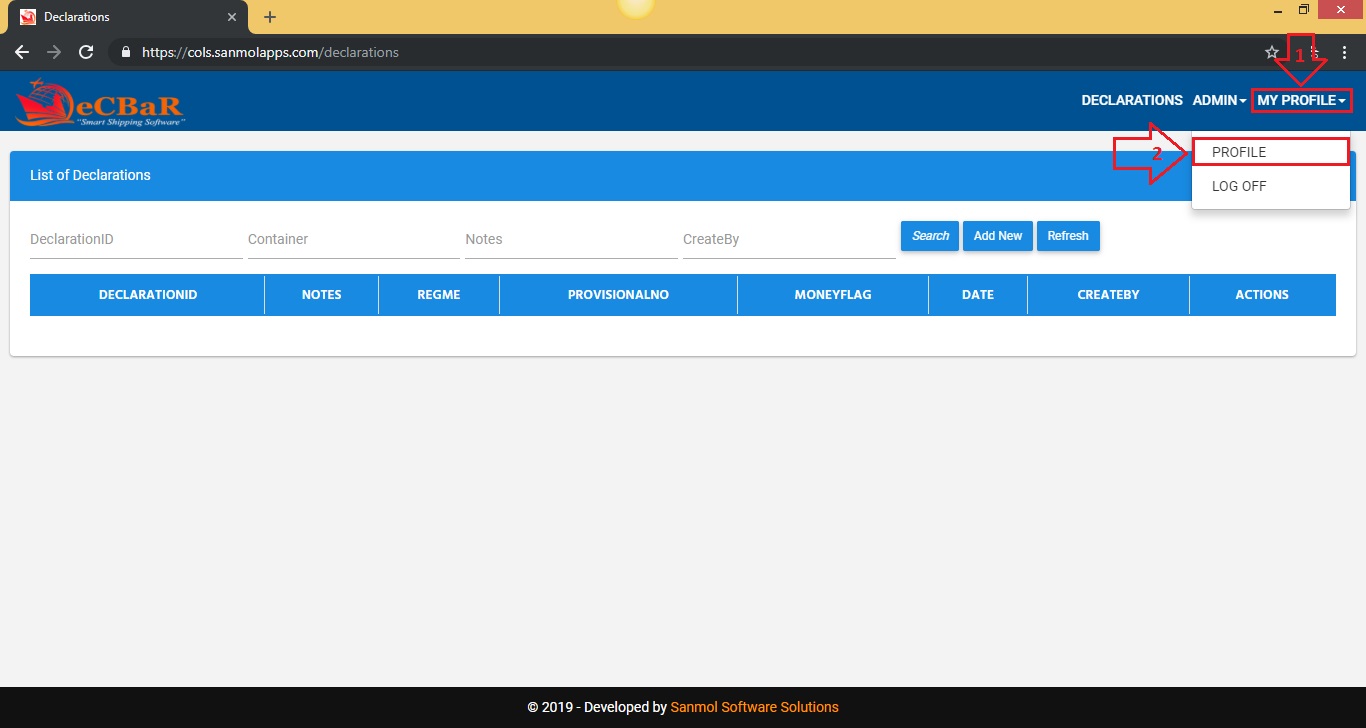

4. My Profile

Click on the My Profile main menu, you can see Profile option click on that.

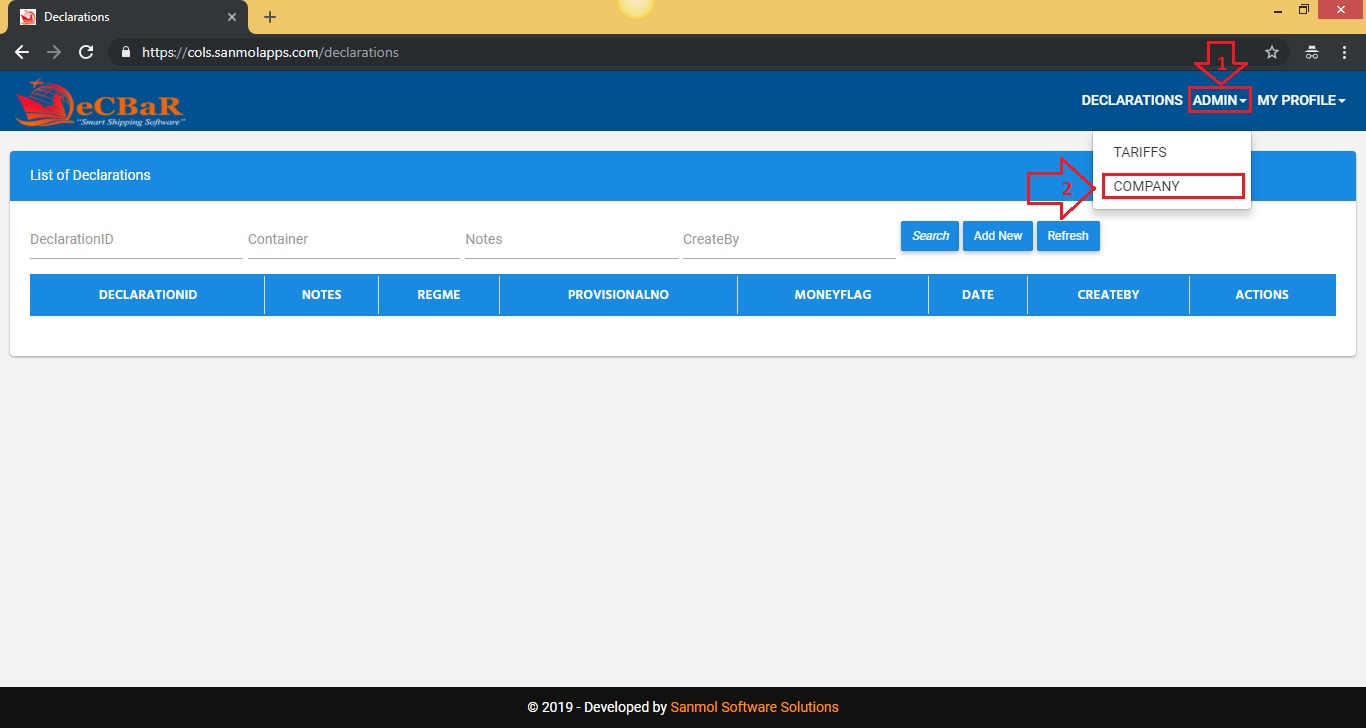

5. Admin - Company

Click on the Admin main menu, you can see Company option click on that.

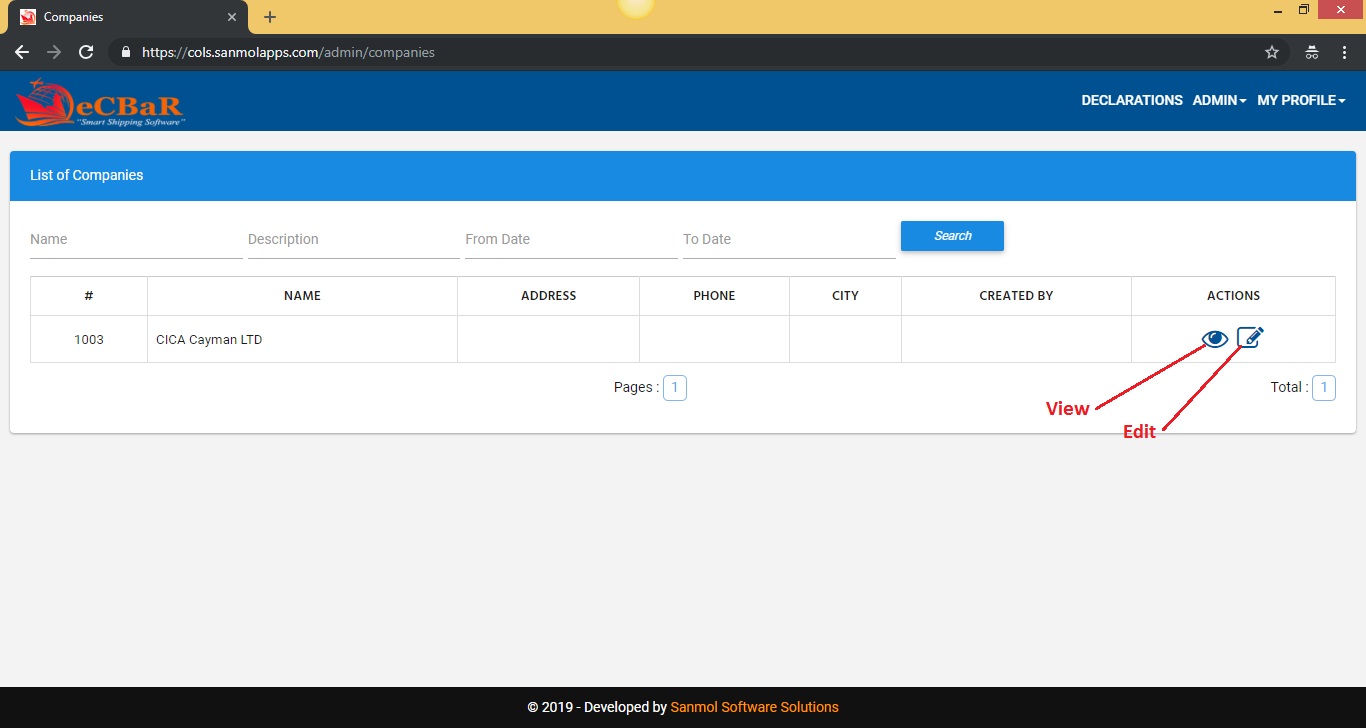

5.1. Admin - Company Details View, Update

When you click on the company option from the main menu you can see company list where you have the options to view and update company details.

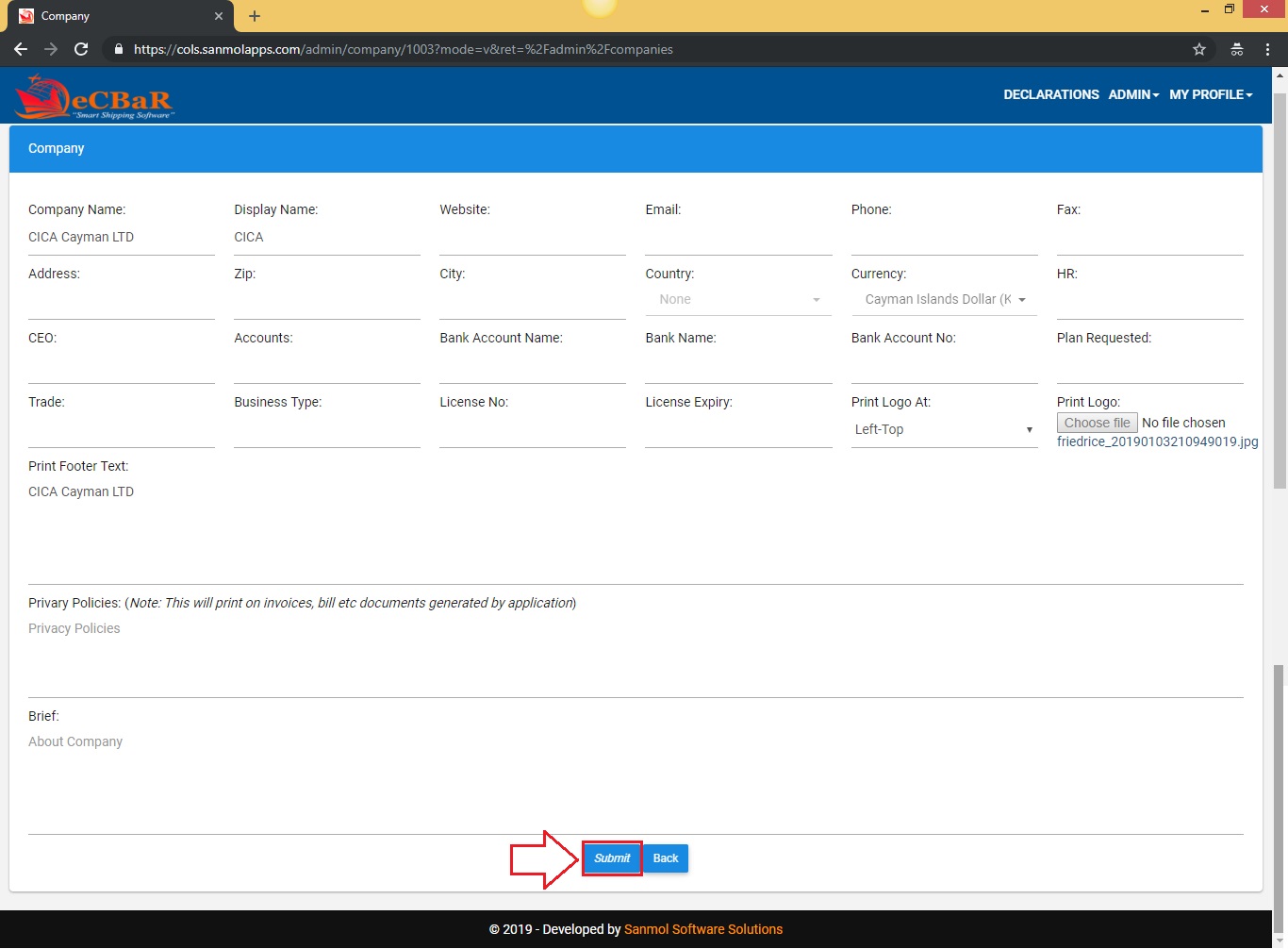

5.2. Admin - Company Details Update

When you click on the edit button from the company list, you have the option to update company details.

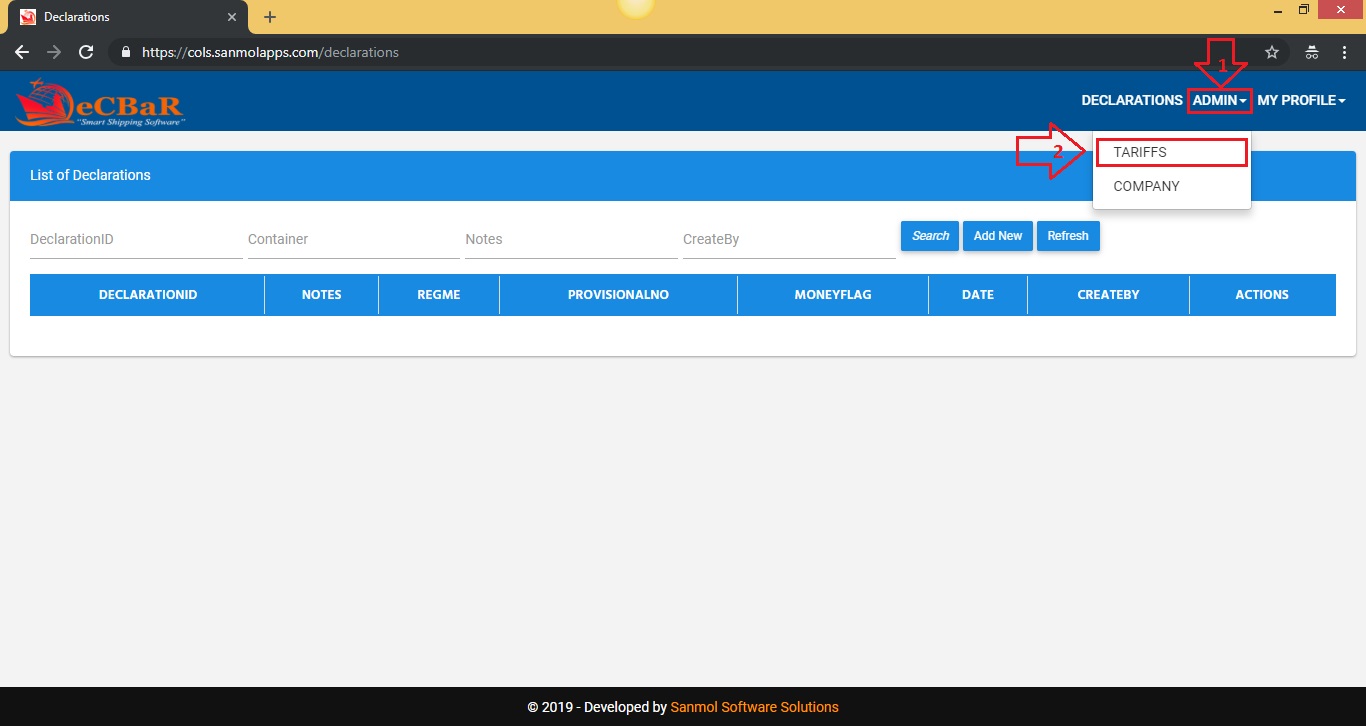

6. Admin - Tariffs Code

Tarrif option is given for adding, updating and deleting Tarrif codes. In the application as per Cayman Customs codes added. If you want to change code description as per your company requirement you can update or if you want to add new code you can add. Click on the Admin main menu, you can see Tarrif option click on that.

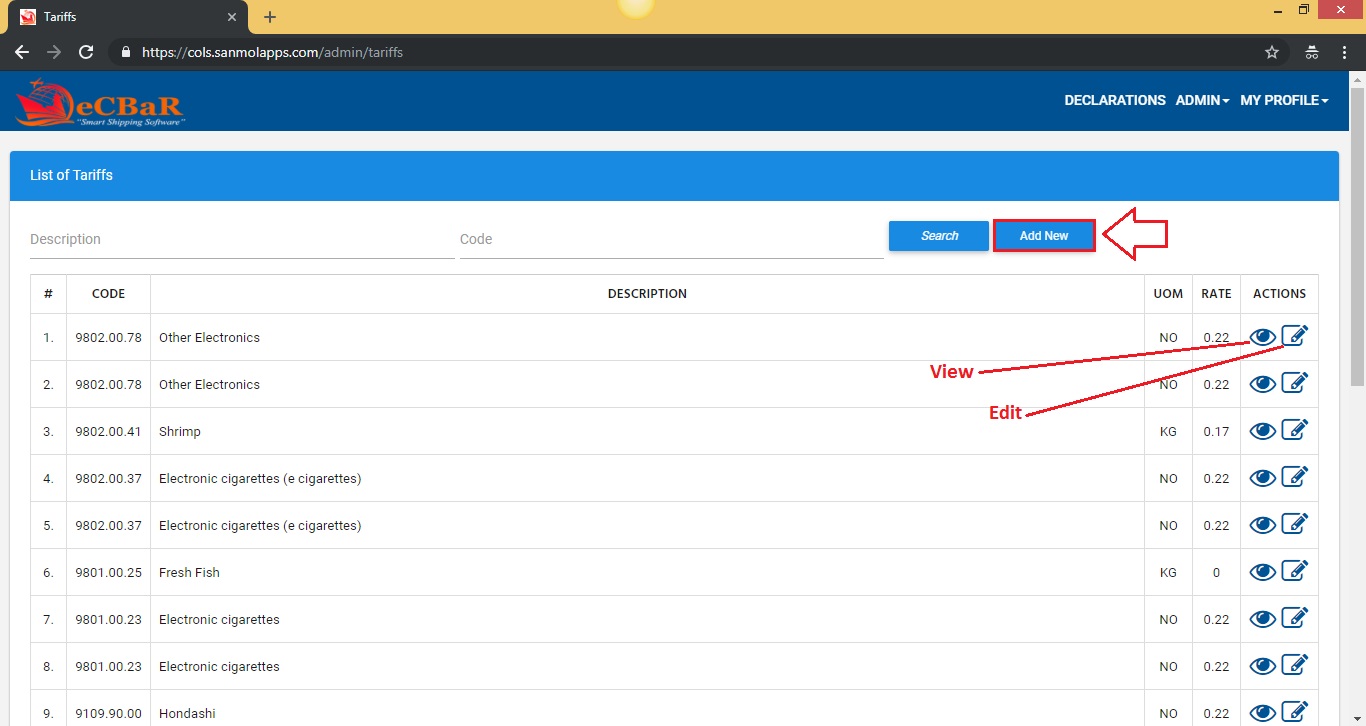

6.1. Admin - Tariffs Code List

You can see all Tarrif code list on the screen. You have option to view, add, update and delete specific Tarrif code from there.

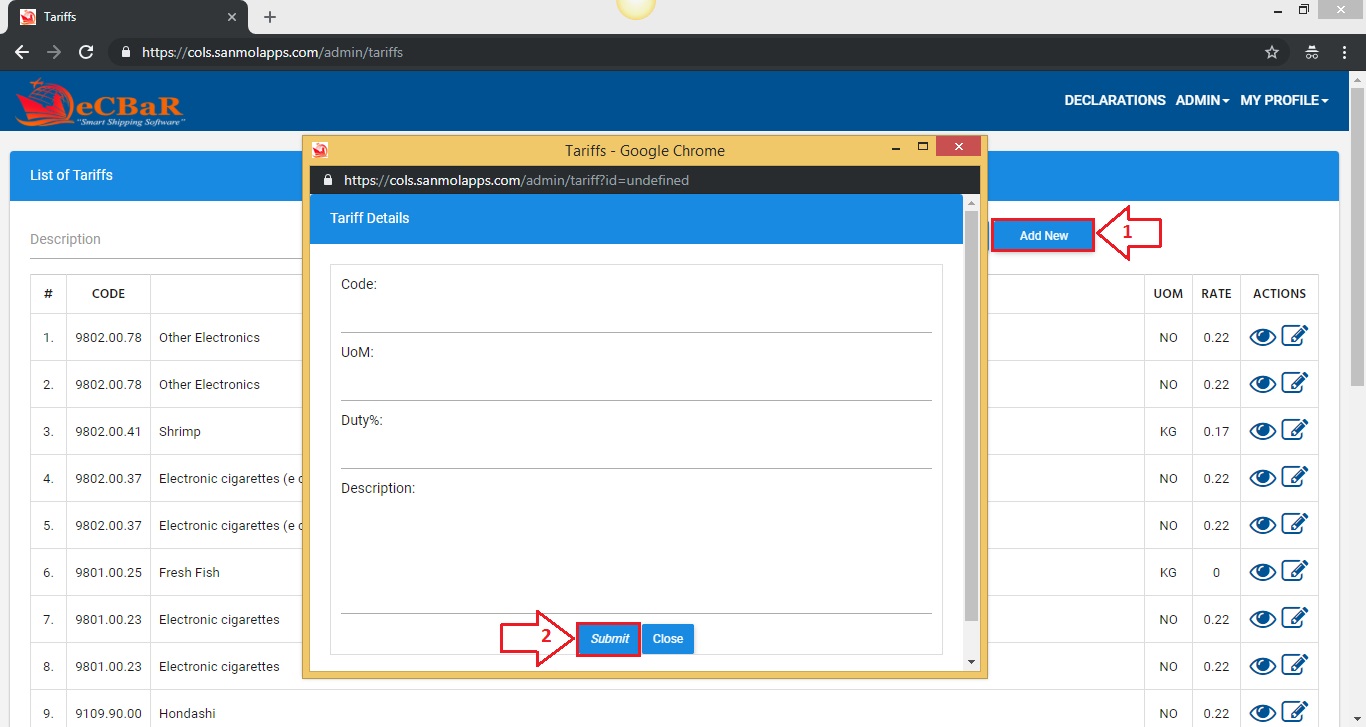

6.2. Admin - Tariffs Code Add New

If you didn't get any require Tarrif code in the application you can add that Tarrif code from the add new button.

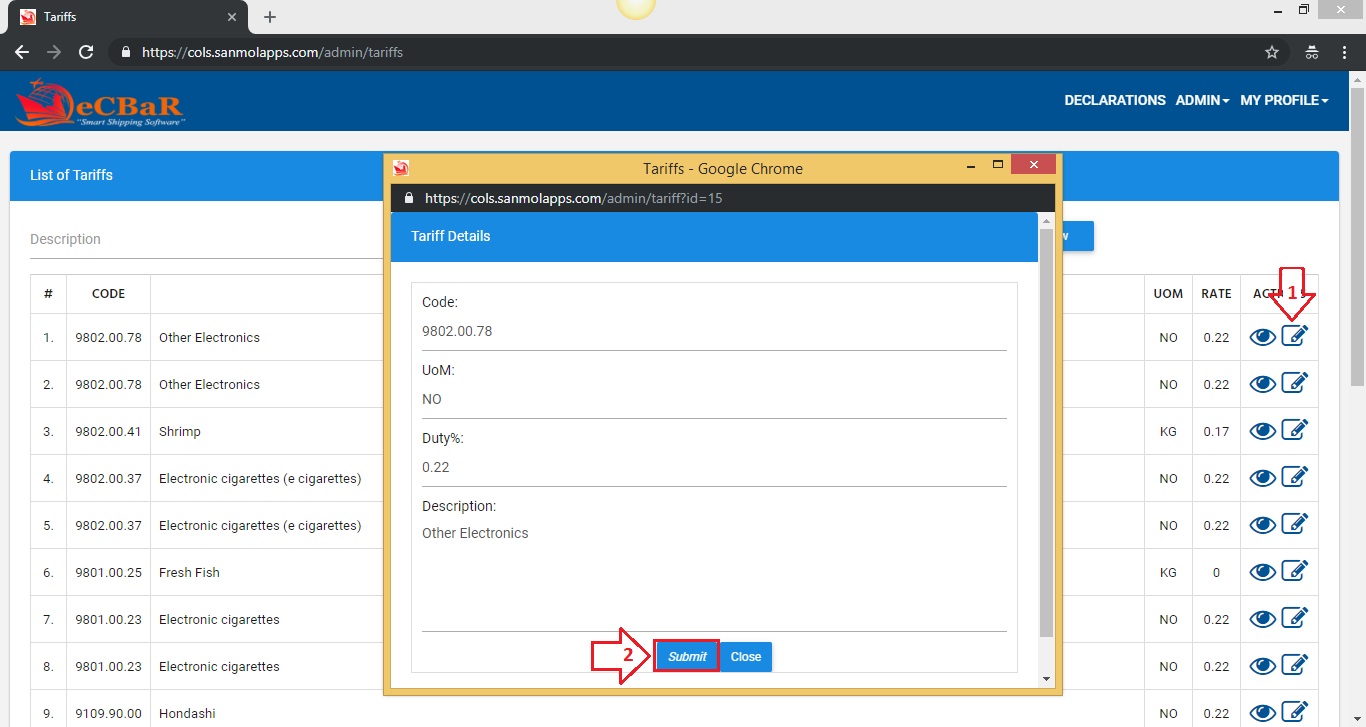

6.3. Admin - Tariffs Code Edit

If you want to edit any Tarrif code which is previously added you can edit after click on edit icon from Tarrif code list..

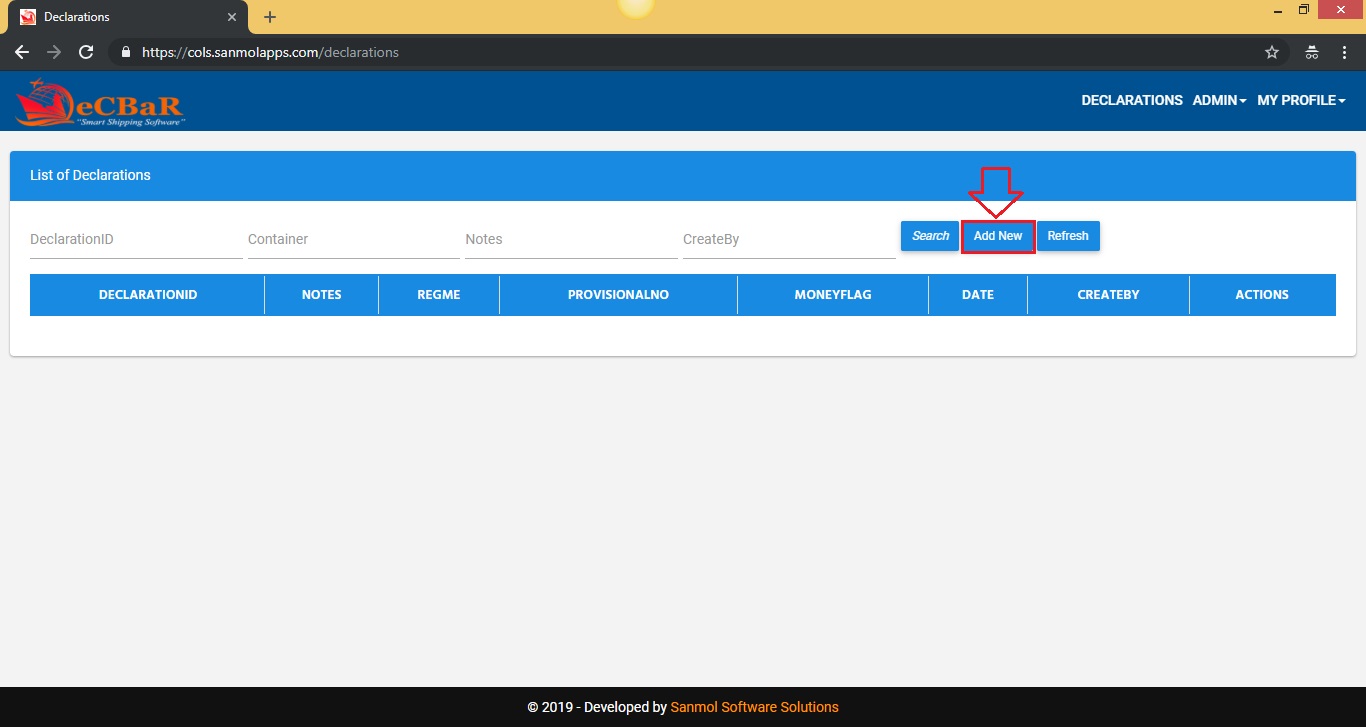

7. Declarations - Add New

Click on Declarations option from main menu. You can see list of declarations which you added previously, if you are using this application first time blank screen will show. Click on Add New button from the main screen of the declaration as per shown in the screen. Note: Don't click on submit button till all tab forms fill, just click on perticular tab and fill the require details.

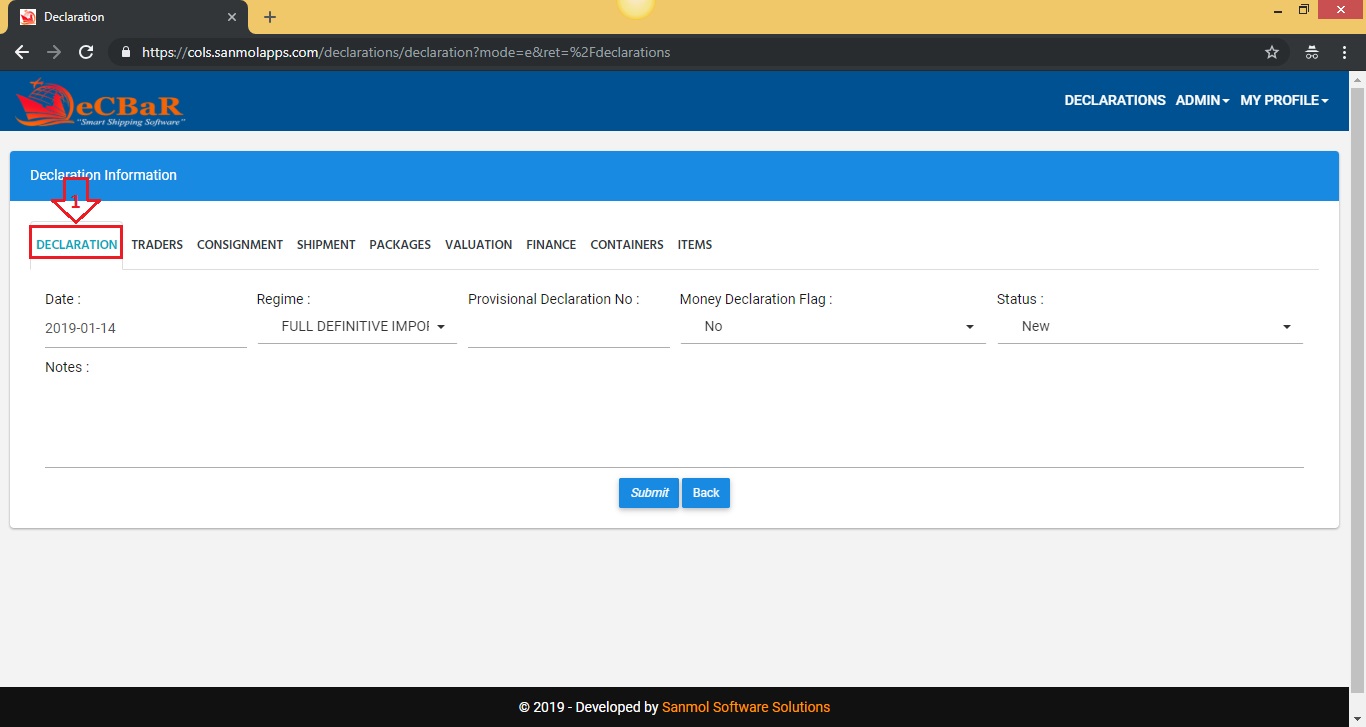

7.1. Declarations

In this tab you need to fill Date, Regime, Provisional Declaration No, Money Declaration Flag, Status.

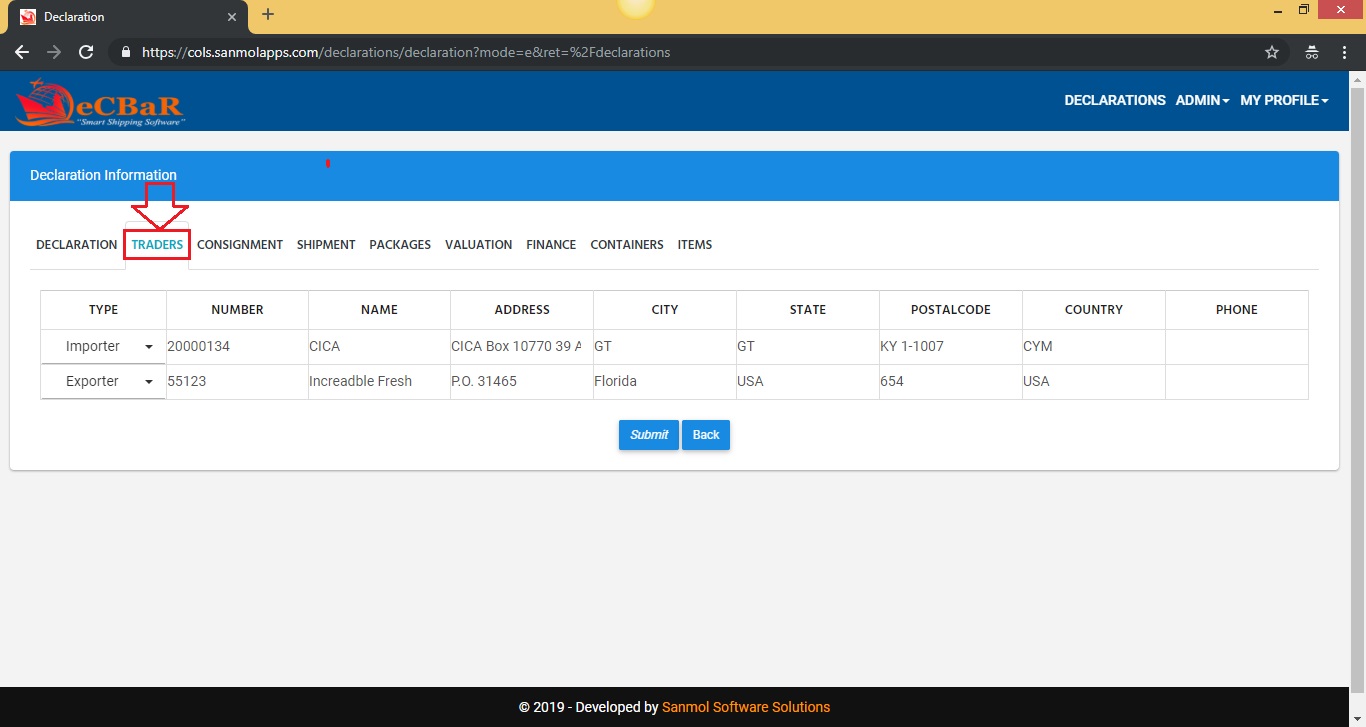

7.2. Traders

In this tab you need to fill all the Importer Exporter details. For state and country use the country'shortcodes like CYM for Cayman Islands, USA for United States of America.

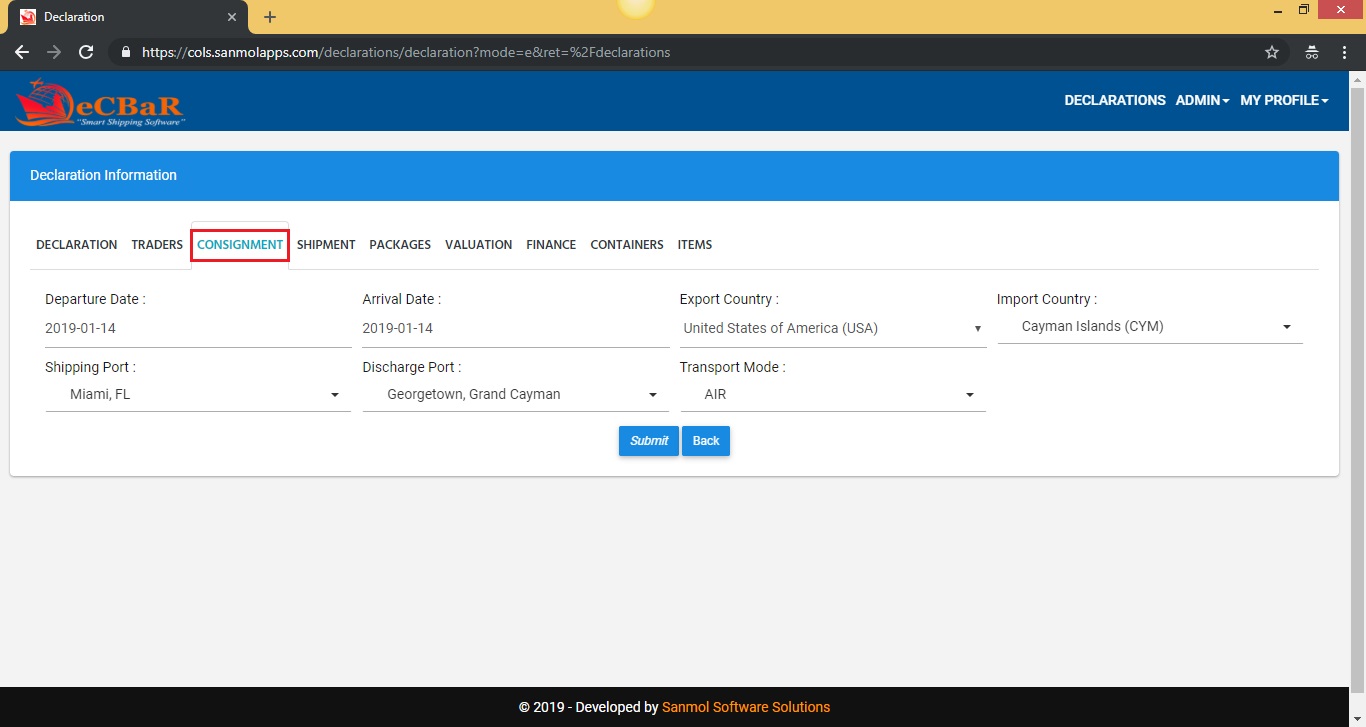

7.3. Consignment

In this tab you need to fill all the Consignment details. Departure date, Arrival date, Export country, Import country, Shipping port, Discharge port, Transport mode.

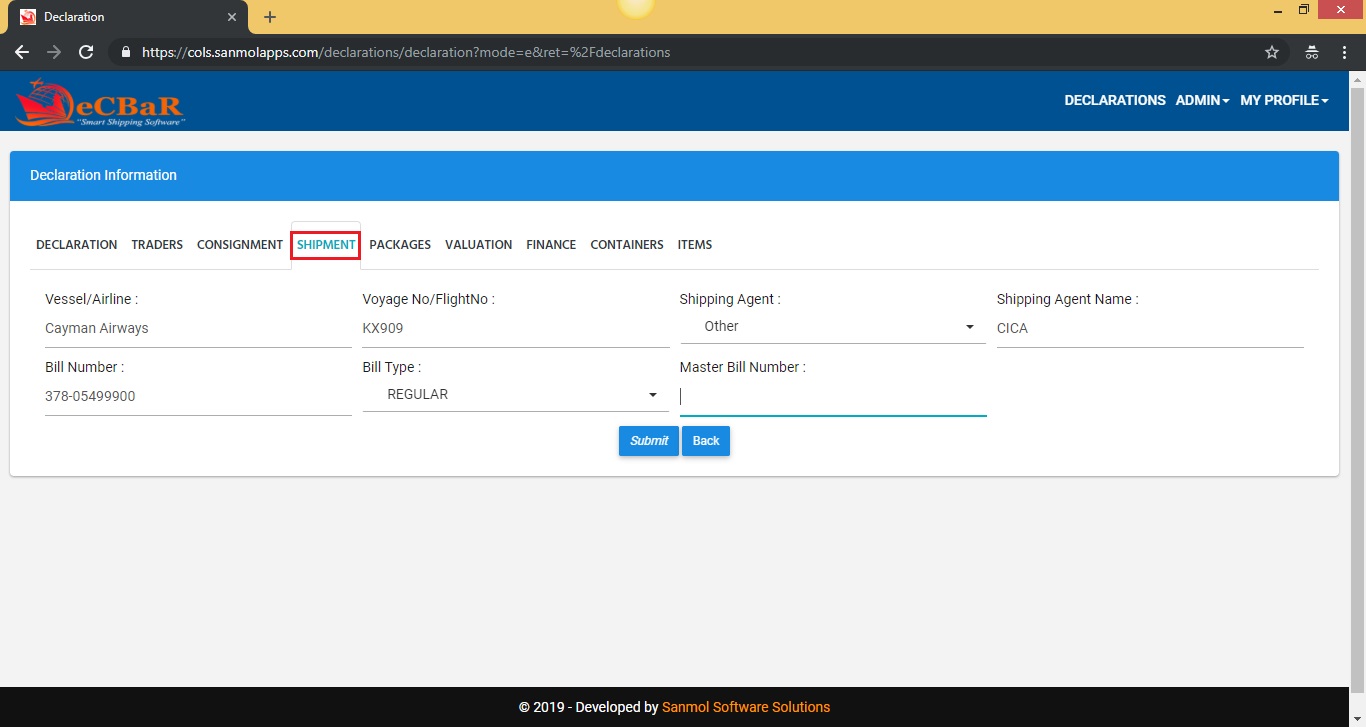

7.4. Shipment

In this tab you need to fill all the Shipment details. If you don't have some information you can keep blank.

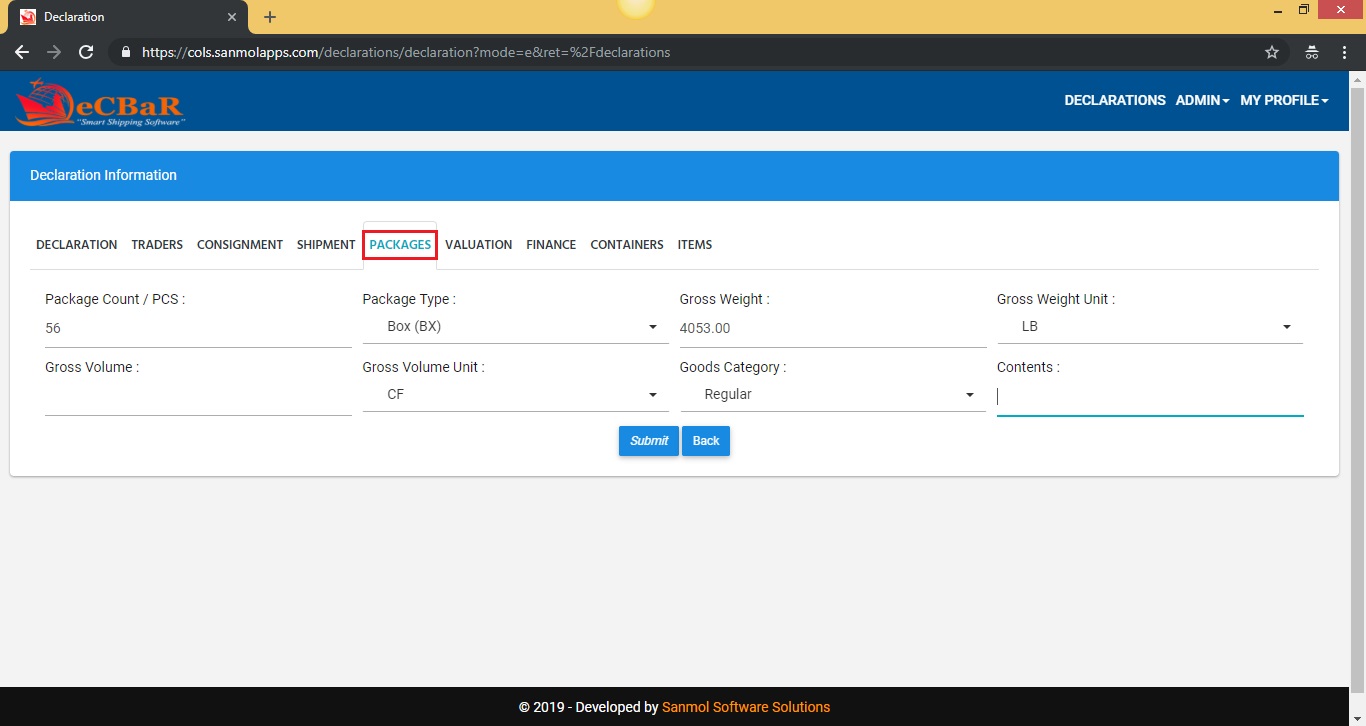

7.5. Packages

In this tab you need to fill all the Packages details. Here Package count means total number of boxes or pieces, select Package type as per shipment packages, Total weight of the all pieces, Weight unit, Goods Category keep regular, Contents you can keep blank if you want.

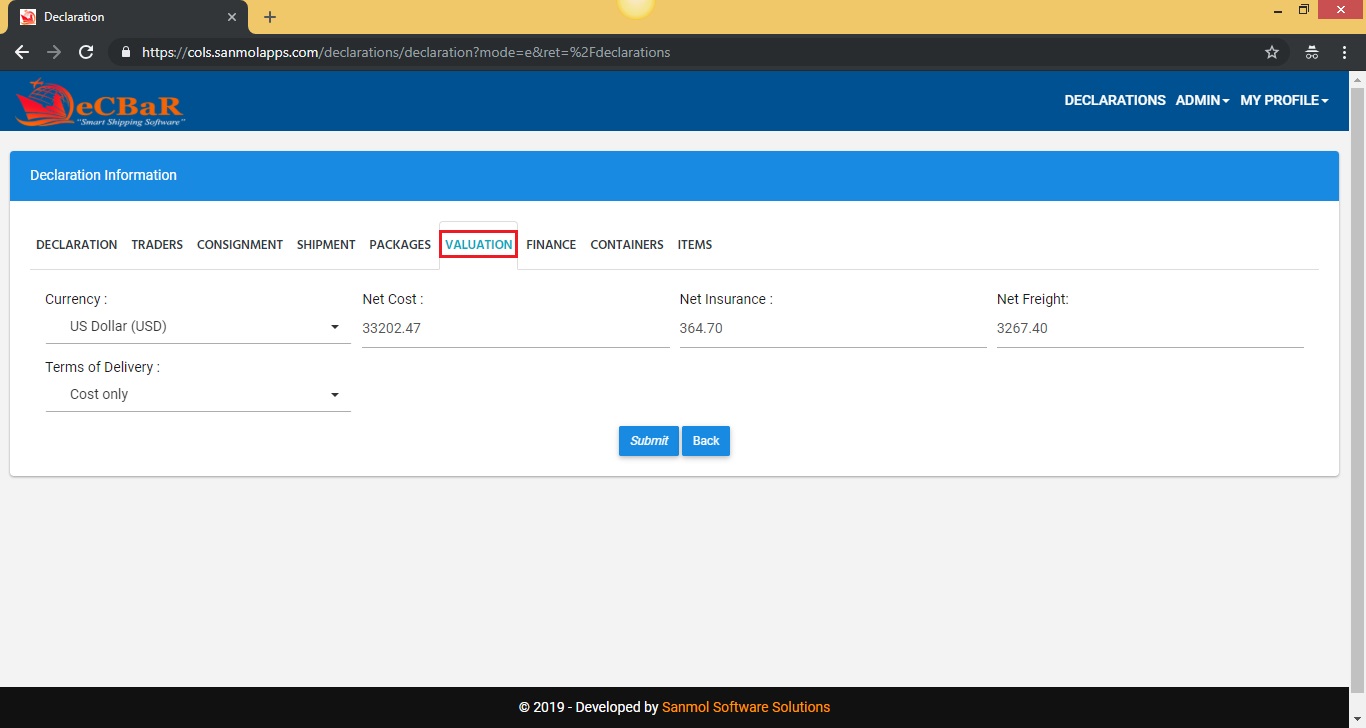

7.6. Valuation

In this tab you need to fill all the Valuation details.

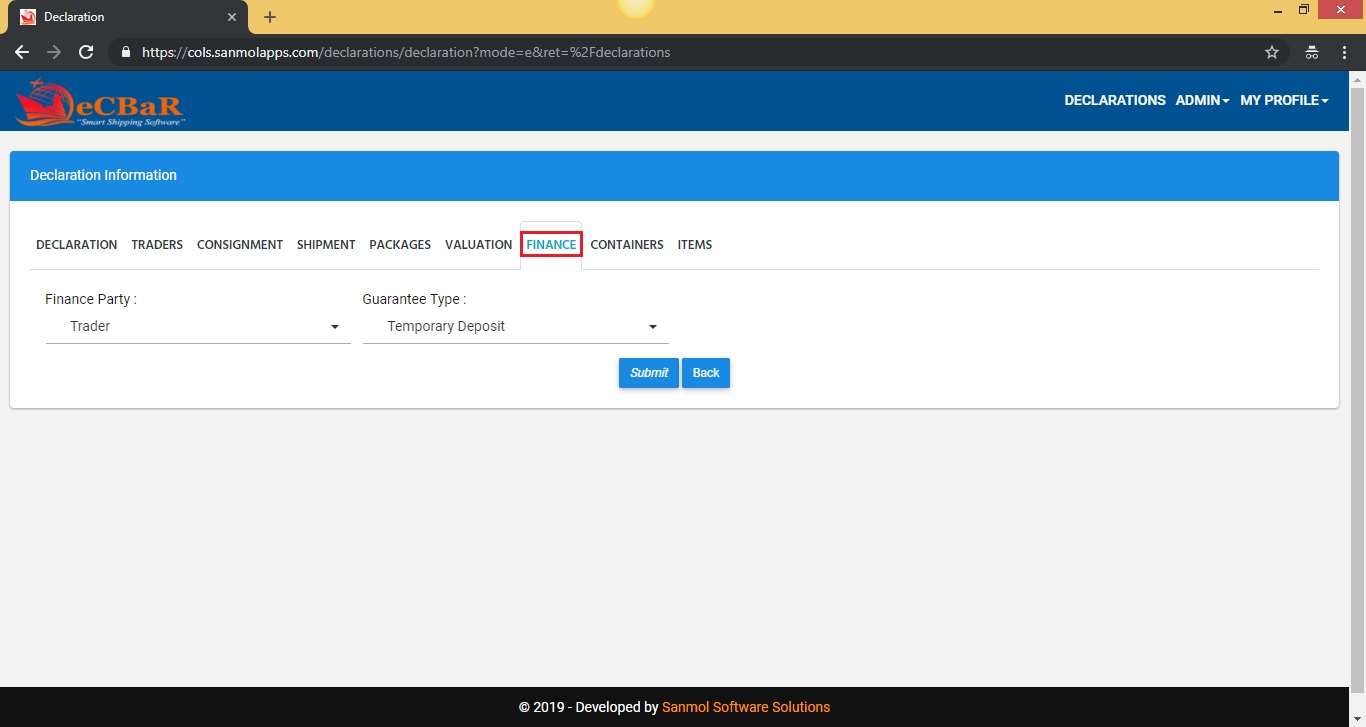

7.7. Finance

In this tab you need to fill all the Finance details.

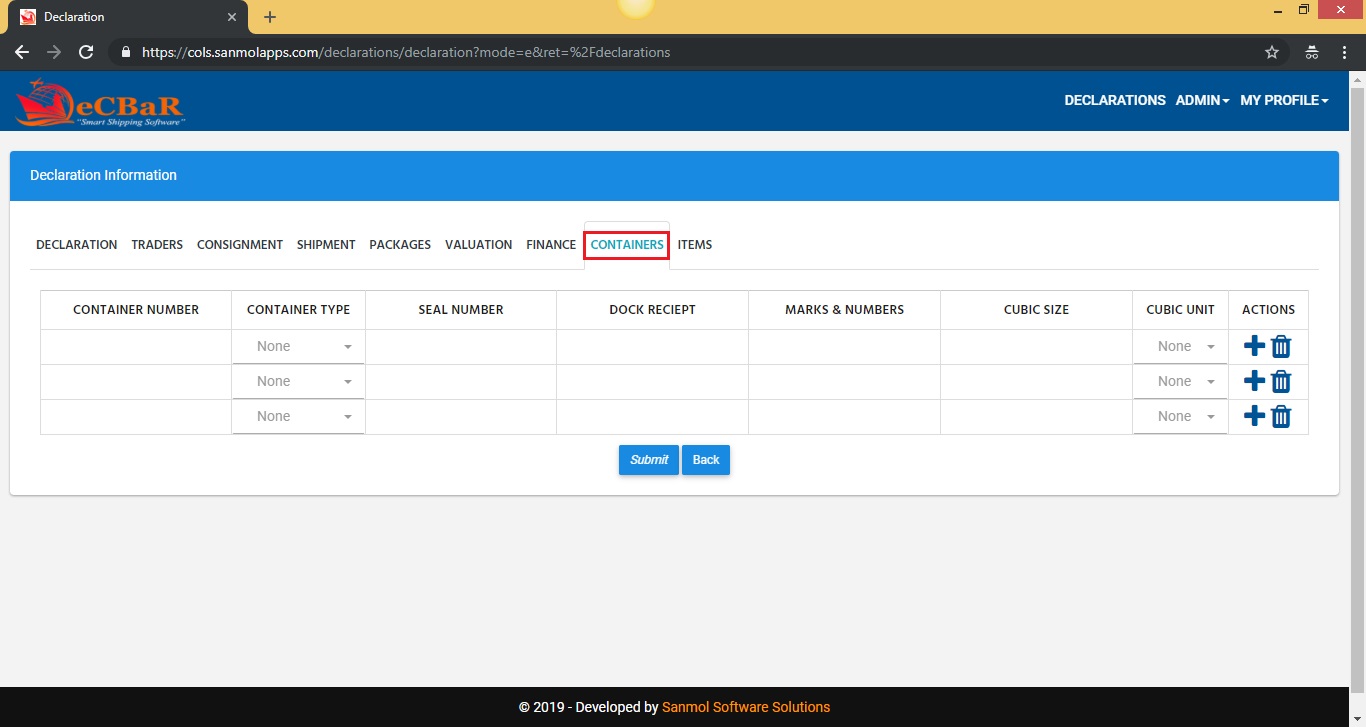

7.8. Containers

In this tab you need to fill all the Containers details. You can keep this blank.

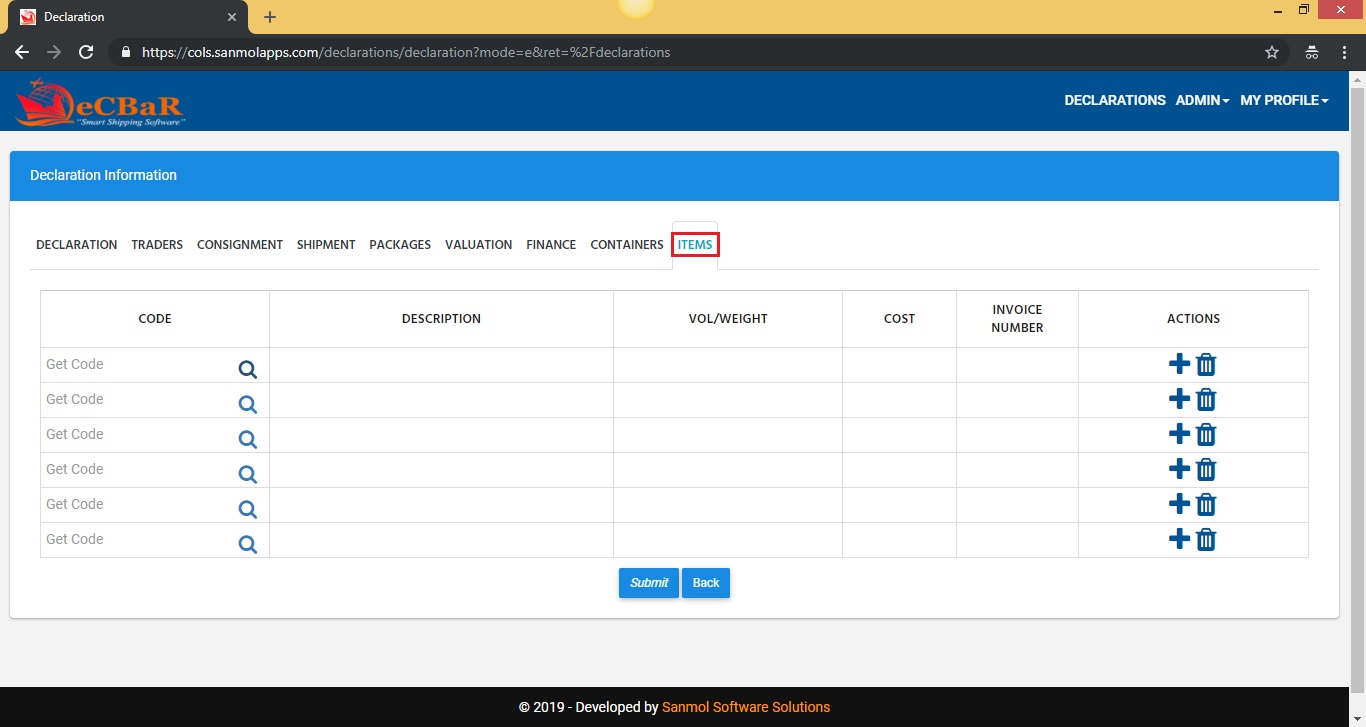

7.9. Items

In this tab you need to fill all the Items details. If you prepared item excel file no need to add items one by one. Finally click on submit button. It will redirect to Declarations list and there is option available to upload items excel file.

Please download sample excel file from here Click for download

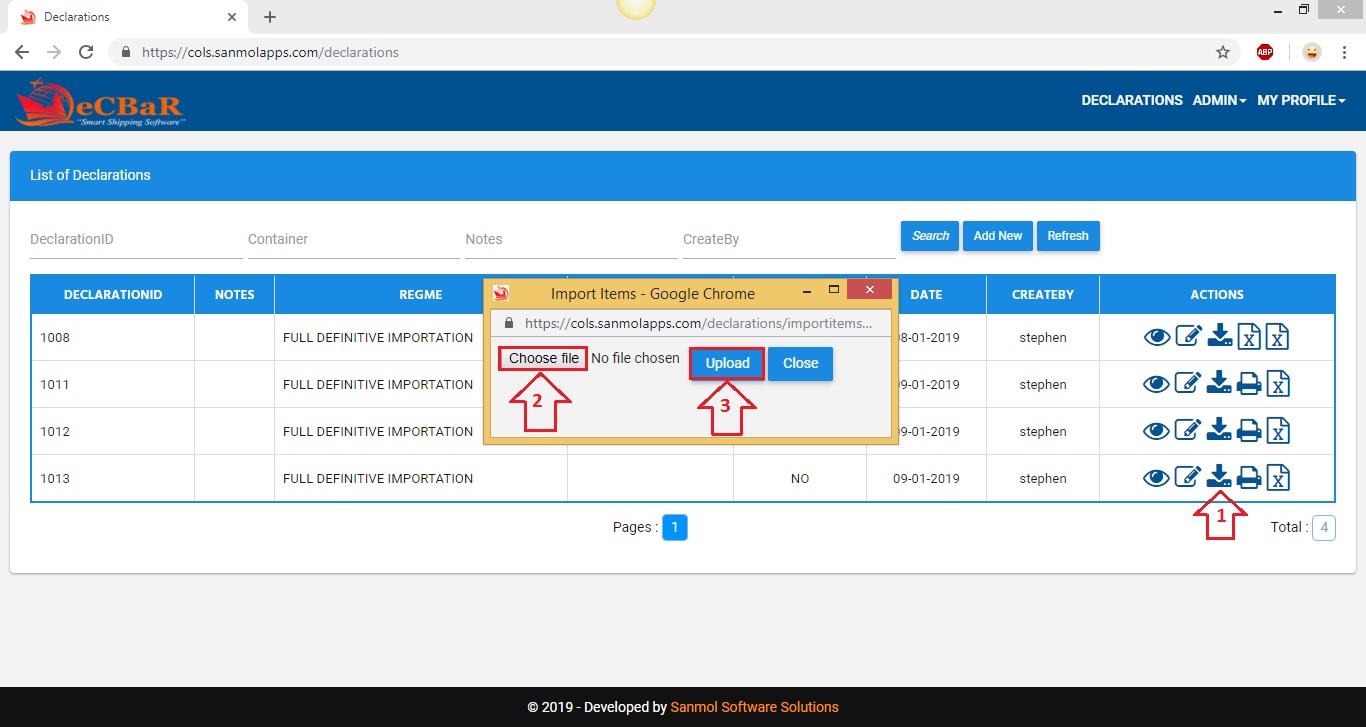

7.9. Upload items excel file

In this option you can upload items excel file.

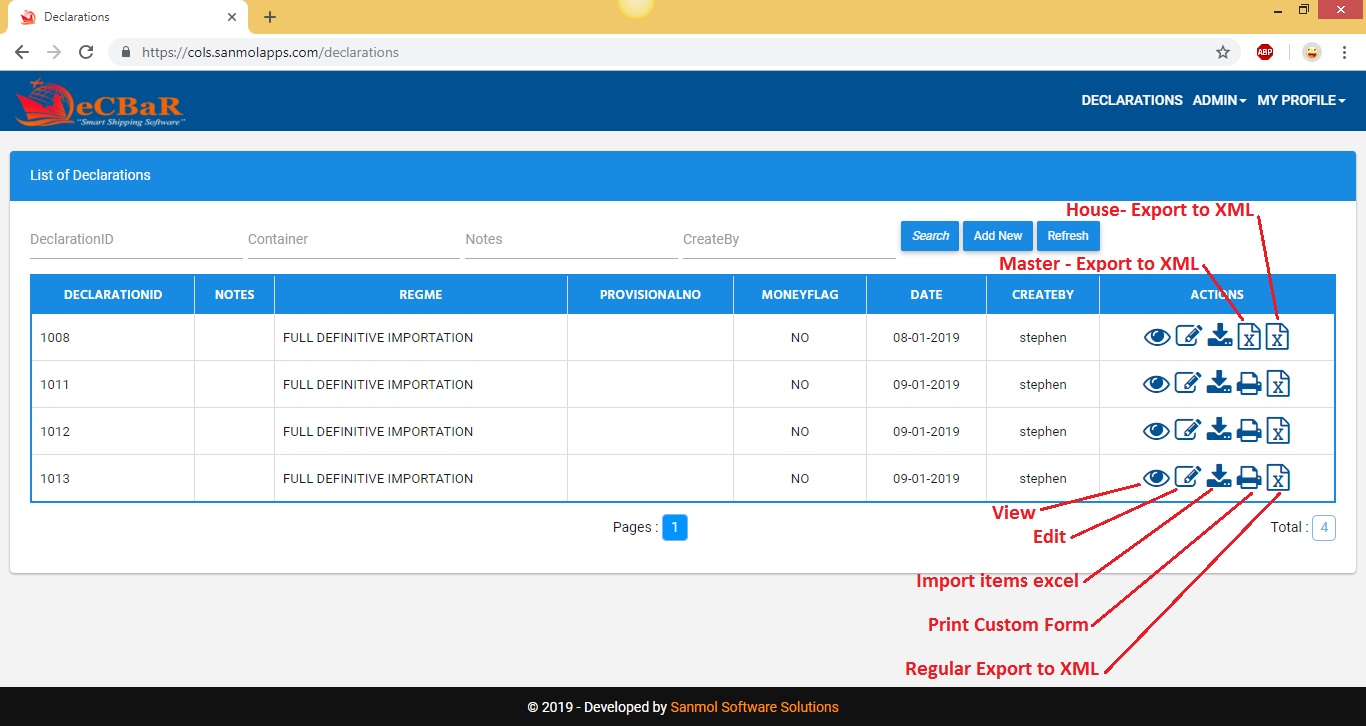

7.10. Declarations List

On the dashboard you can see all previously added declarations list. You have various options to do the operation on the specific declaration entry. You can see various icons shown there.

1. View icon given for viewing the declaration entry.

2. Edit icon given for updating the declaration entry. 3. Import items excel icon given for importing the items excel file into the declaration.

4. House - Export to XML (This XML Require to upload on Govt eCOLS site)

5. Master - Export to XML (This XML Require to upload on Govt eCOLS site)

6. Print Custom Form (You can use this form to submit to Customs if Govt eCOLS site is down)

7. Regular Export to XML (This XML Require to upload on Govt eCOLS site)